How to Set Sales Taxes (e.g. VAT, GST)

Add and manage tax rules

Upmind supports and can configure global sales tax requirements, including:

- UK/EU VAT

- US sales taxes (state and federal)

- Indian GST

- Service charges

- Card processing fees

Taxes in Upmind are customisable and managed using templates and tags, allowing different rules per product and client location.

This guide explains how to set up and configure taxes for your brand, as well as how to debug any issues with the setup.

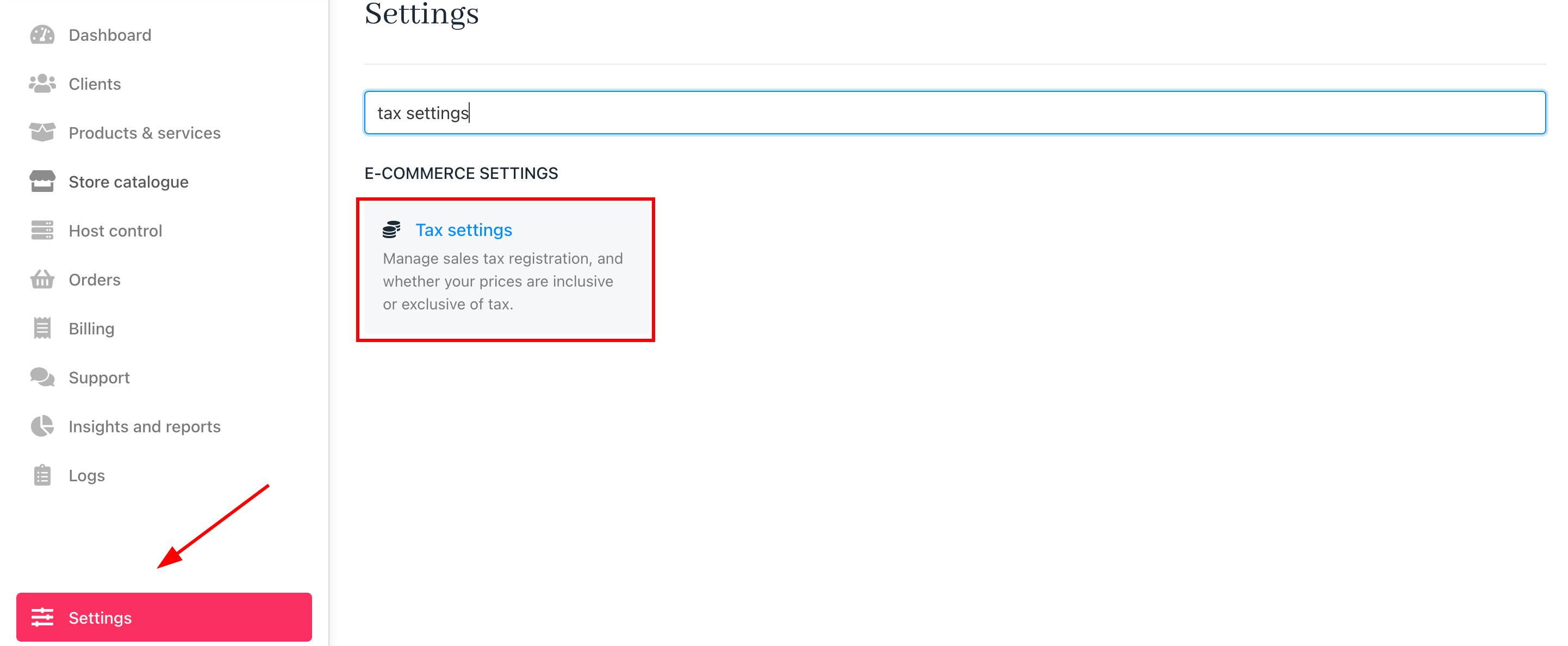

Accessing tax settings

- Log in to Upmind.

- Go to

Settings. - Select Tax Settings from the Ecommerce Settings.

Settings > Tax settings

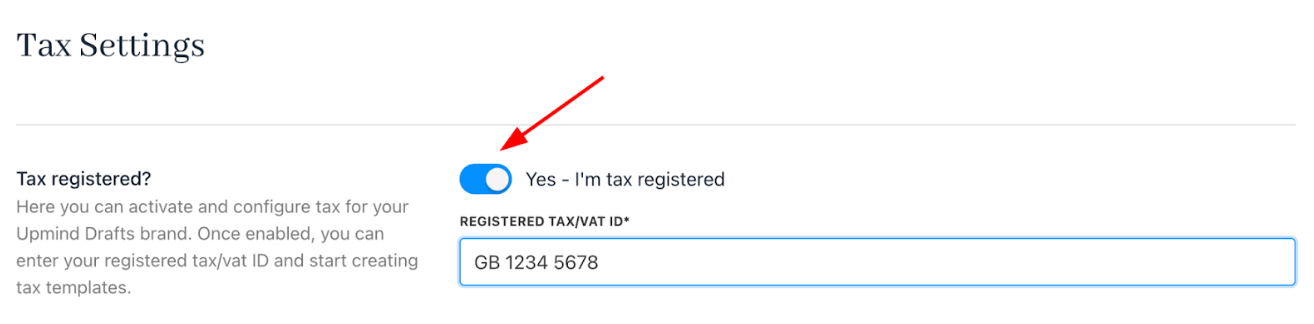

Enabling tax features

Switch the TAX Registered? ON if your business is tax registered, and then enter your tax number for official documentation. This enables tax options throughout your store.

By default, the toggle is OFF, so you can switch it ON if applicable.

Toggle tax settings

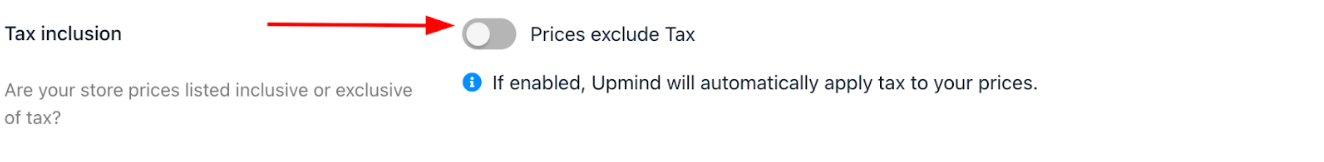

Tax inclusion setting

You can decide if your product prices are tax inclusive (tax included) or tax exclusive (tax added). By default, the setting is off, so Upmind adds tax (if applicable) to the price.

Toggle it ON to indicate prices include tax, and Upmind will deduct tax accordingly.

Toggle tax inclusion

How Upmind handles taxes

Upmind uses tax templates and tax tags to manage taxes efficiently.

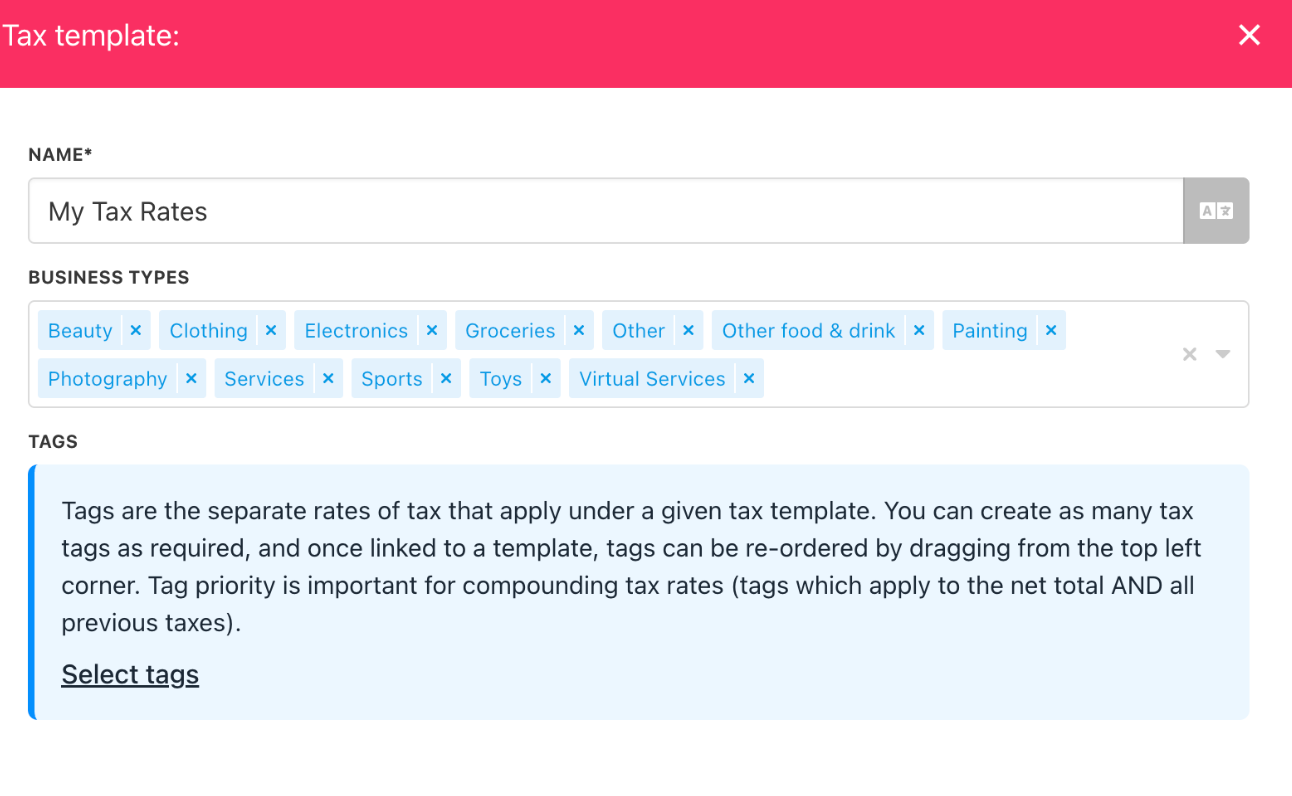

Tax templates

Tax templates are sets of tax rules assigned to products. Each product can have only one tax template, but a template can apply to many products. Templates allow you to apply different tax rules based on product type, location, or client type.

Example: A web design firm might charge local tax on design work, but tax hosting based on the client’s location. Food and beverage businesses may charge higher tax rates on alcohol than on food.

System defaultsYou can optionally import our system default tax templates, which cover the most common tax options.

You can create tax templates by clicking Add Tax Template, naming it (visible only to you), and selecting the applicable business types (commonly Virtual Services). Then, assign tax tags to the template.

Tax template

Tax tags

Tax tags are individual tax rules within a template. They can be fixed fees or percentages and may include secondary rates. When applied, Upmind processes tax tags in order, applying those relevant to the invoice.

Example: Two tax tags applied:

Tax tag

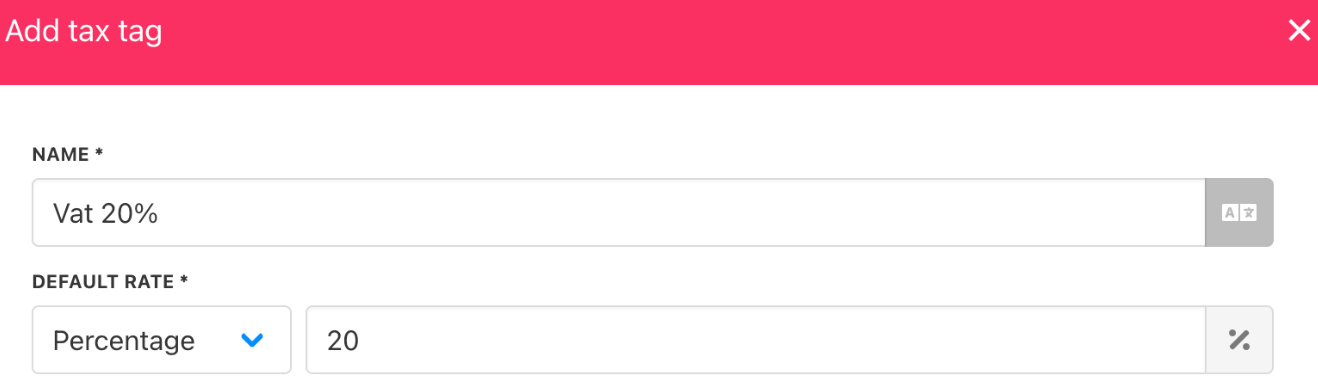

When creating a tax tag, you:

- Name the tag.

- Choose the default fixed or percentage fee and enter the amount and currency.

Tax tag name and fee

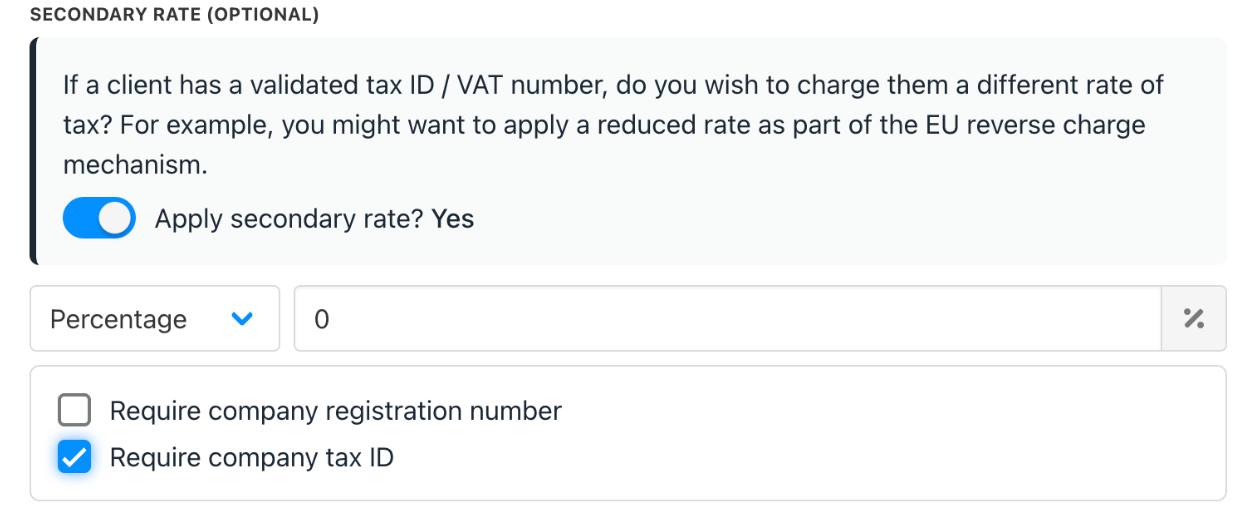

- Optionally add a secondary rate for specific business types, such as businesses rather than individuals. This is common in the EU under the reverse charge mechanism for applicable countries.

Secondary rate

- Set display options (show tax at invoice or item level).

Display options

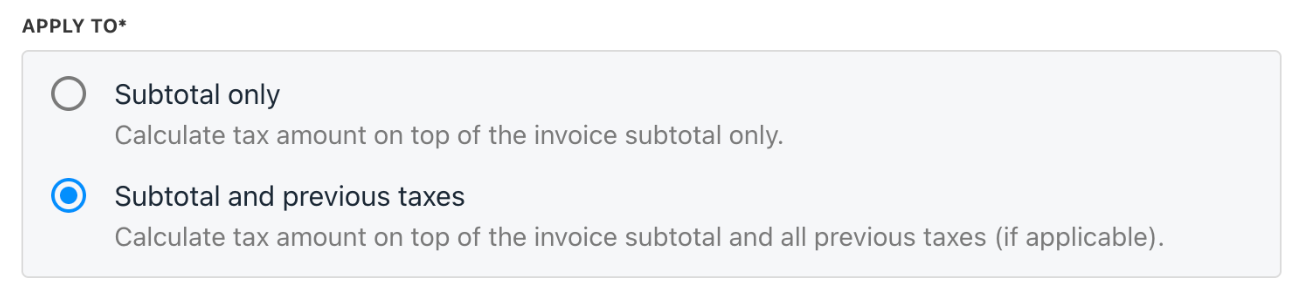

- Choose whether tax applies to the subtotal only or the subtotal plus previous taxes.

Apply to

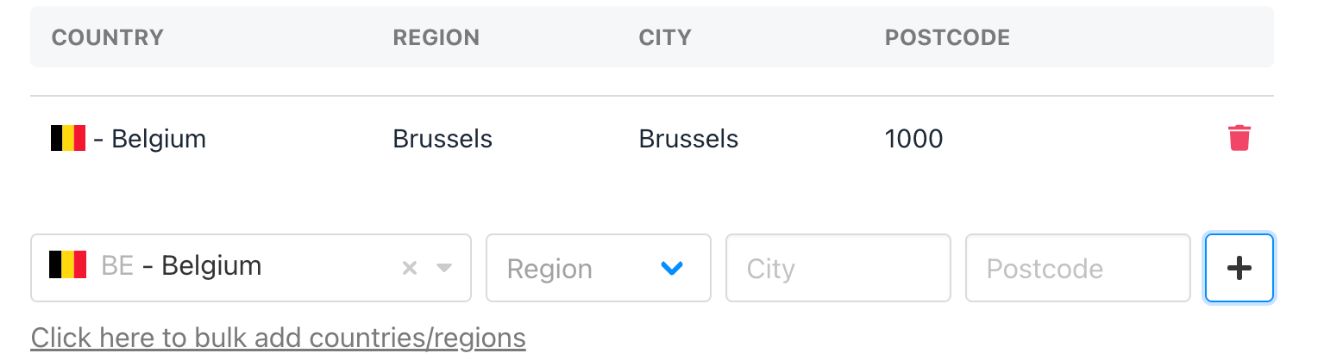

- Assign applicable locations (countries, regions, client types).

Locations

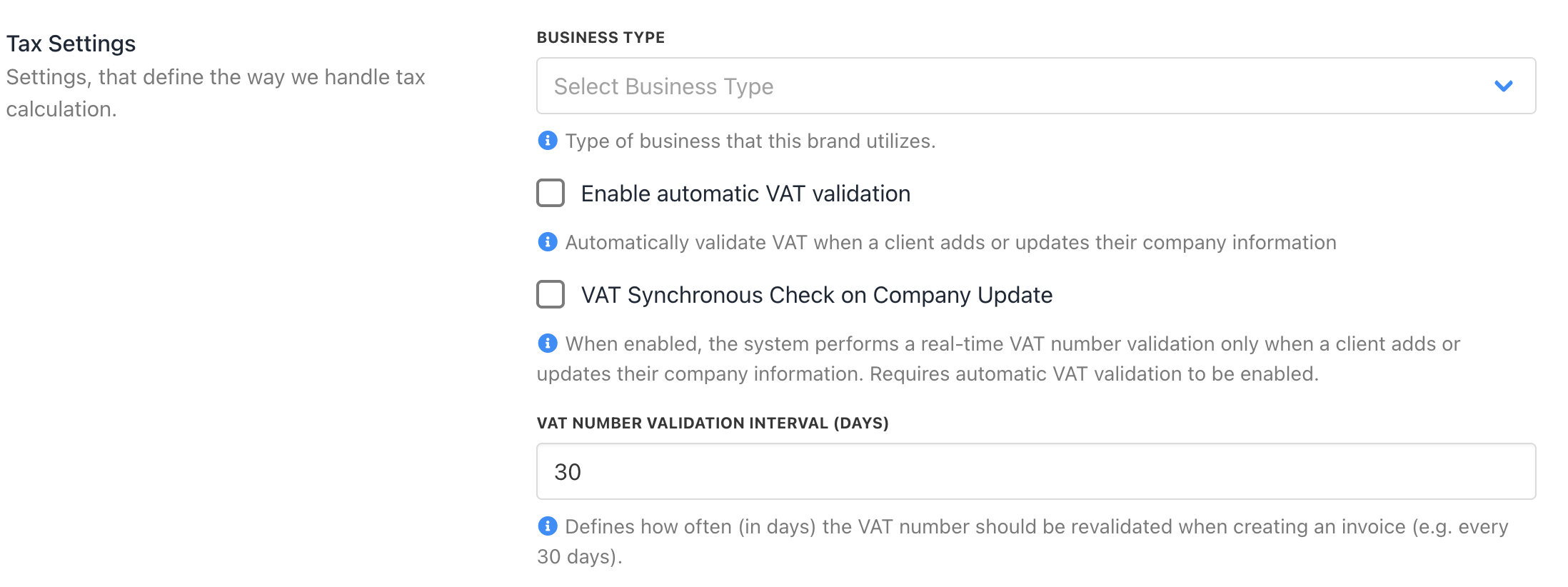

Tax settings

Tax settings control how Upmind calculates and applies taxes across invoices and products.

Tax settings

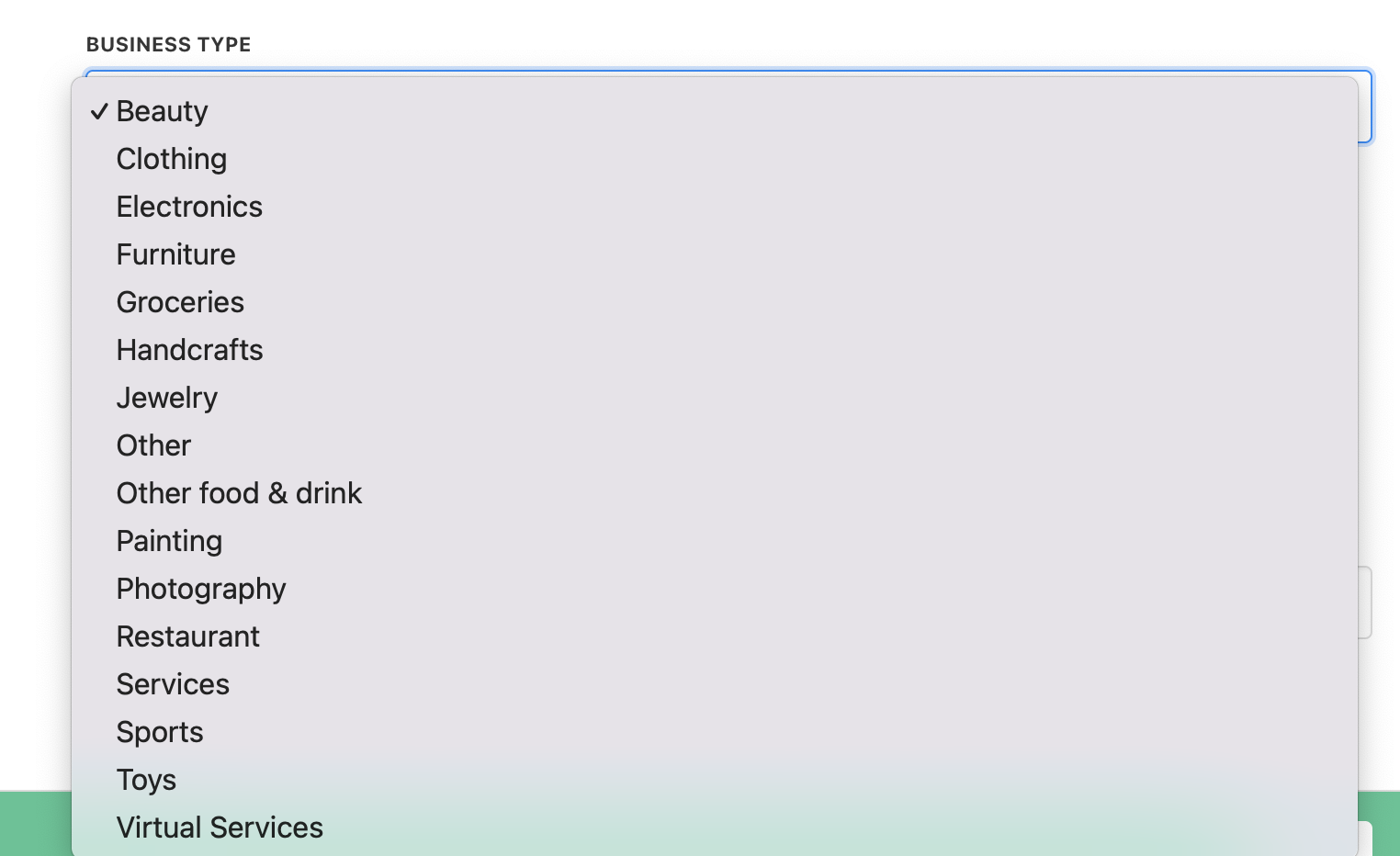

Business Type: You can pick the type that matches your operations from a range of options. Upmind uses this to apply correct tax rules and templates automatically.

Business type

Automatic VAT Validation: Turn on to check VAT numbers automatically when clients enter or update company details. Upmind queries external services for validity in real time.

Automatic VAT validation

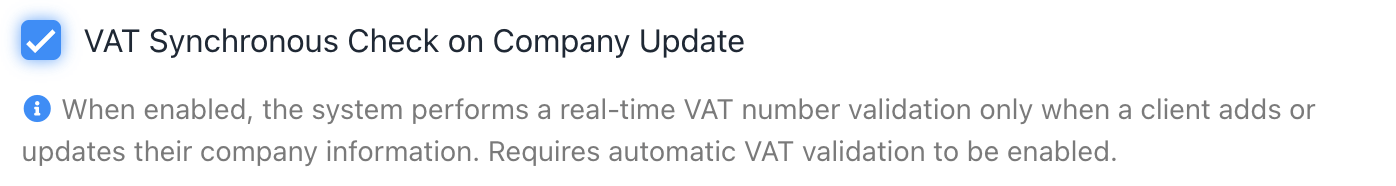

VAT Synchronous Check on Company Update: Activate for instant VAT checks during company info changes. This requires Automatic VAT Validation to be enabled and speeds up validation without delays.

VAT synchronous check on company update

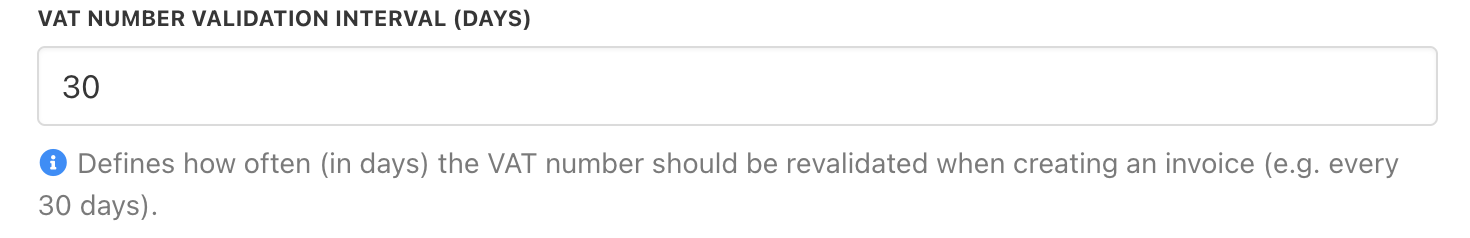

VAT Number Validation Interval: Set days between rechecks of VAT numbers on invoice creation, like 30 days. Upmind skips checks if within the interval to save time and API calls.

VAT number validation interval

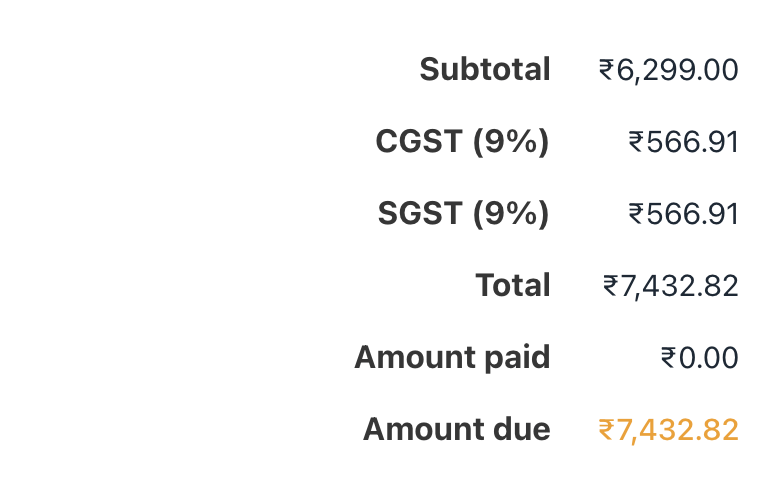

Tax on invoices

When an invoice is generated, Upmind shows a tax summary and a breakdown of taxes charged.

Applying taxes by location

Upmind determines applicable taxes based on the client’s address or, if none is provided, their IP geolocation at the country level. If a client adds an address, the tax rate is recalculated for greater accuracy.

Since IP geolocation only identifies the country, regional tax rules require a client’s address to apply correctly; otherwise, no tax rate will display for specific regions.

Example: Indian GST System

India has three sales tax types:

- IGST: Charged on inter-state transactions.

- CGST: Charged on intra-state transactions by the central government.

- SGST: Charged on intra-state transactions by the state government.

So, a business in Maharashtra charges SGST for local clients and both IGST and CGST for clients in other states.

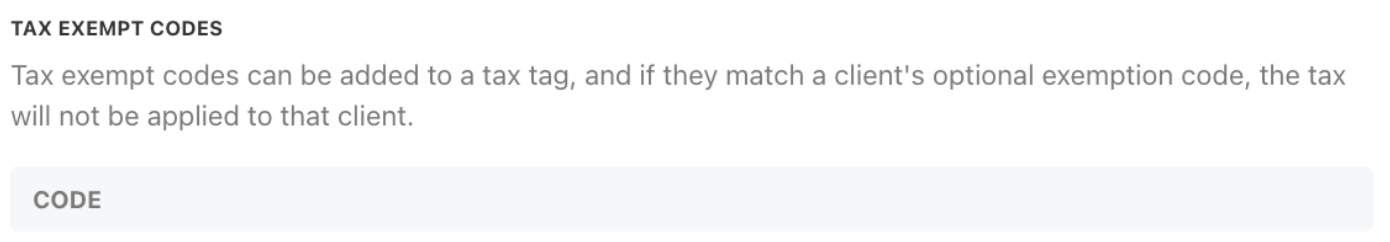

Tax Exemption Codes are added under the tax tag

Consult your accountant for tax advice. Upmind provides software support but does not replace professional guidance. You can import system default tax templates covering common tax scenarios.

Updated 12 days ago